The Tax Cuts and Jobs Act contains a large number of provisions that will affect individual, estate, and corporate taxpayers. We have highlighted a few of the more salient details. Most of the items are effective beginning January 1, 2018.

For Individuals

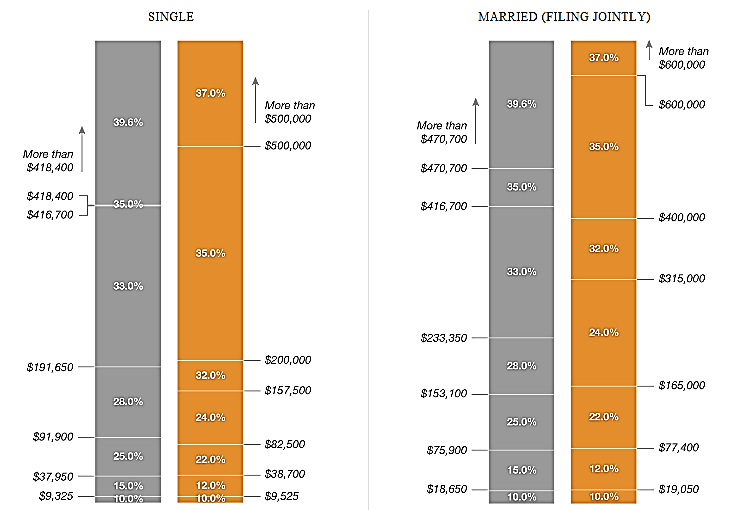

- Tax brackets have changed, with almost all levels of taxable income subject to a lower rate. The following chart identifies the impact on individuals and singles:

2017 2018-25 2017 2018-25

- The standard deduction will be $24,000 for married taxpayers filing jointly, $18,000 for heads of households, and $12,000 for all other individuals.

- Individuals can no longer claim personal exemptions.

- The child tax credit is $2,000 per qualifying child. The phase out for this begins for married couples when adjusted gross income exceeds $400,000 ($200,000 for single taxpayers).

- Itemized deductions:

- Deductible mortgage interest for the purchase of new homes is capped at loans of $750,000.

- The home equity loan interest deduction is repealed.

- Individuals are able to deduct a maximum of $10,000 in a combination of state sales or income and local property taxes.

- Miscellaneous itemized deductions are repealed. This includes unreimbursed business expenses.

- For tax years after 2017 and before 2026, individuals are allowed to deduct 20% of qualified business income from a partnership, S corporation, or sole proprietorship. Qualified business income has various definitions and limitations, so eligibility will need to be conducted on an entity by entity basis.

- There is no individual mandate penalty for taxpayers who do not obtain insurance, effective after 2018.

For Estates

- The basic exclusion amount for the estate, gift, and generation skipping transfer taxes has doubled from $5.6 million to $11.2 million (effectively $22.4 million for a married couple), beginning in the 2018 tax year.

For Corporations

- The corporate tax rate will drop to 21% starting in 2018.

- The bill increases the maximum amount a taxpayer can expense under Section 179 to $1,000,000 and increases the phase out threshold to $2,500,000. This is indexed to inflation. In addition 100% bonus depreciation applies to assets placed in service after September 27, 2017 and through 2022. The acquisition of used equipment will now also be eligible for bonus depreciation.

- The bill also expands the definition of Section 179 property to include roofs, HVAC systems, fire suppression and security systems.

- The deductibility of interest expense in certain cases may be limited. This restriction does not apply to interest incurred on floorplan related debt.

- Entertainment expenses will no longer be deductible.

In general, the changes to the corporate tax laws are permanent. However, the individual and estate tax provisions will generally expire by 2026.

If you have any questions regarding this article, please contact Jamie Downey at JMDowney@DowneyCoCPA.com or at 800-849-6022.